Lot 108 Hitchcocks Lane, Berry, Nsw 2535

Transform your home building journey with our user-friendly budget planner calculator, crafted to simplify your budgeting process. This intuitive tool allows you to effortlessly track your expenses, ensuring you stay on top of your spending habits. With features that enable you to set personalised savings goals, you can achieve your dream Mojo home without the stress of financial uncertainty.

Simplify your budgeting process with our user-friendly budget planner calculator, designed to help you track expenses, set savings goals, and build your dream Mojo home.

Our MyChoice Home Loans calculators are the perfect starting point to help you get your finance journey moving. Use them to start building an understanding of your own financial situation before you chat to one of the friendly MyChoice Home Loans brokers.

Enter your income and expenses to estimate how much you may be able to borrow to build your new Mojo home.

Work out how much your home loan repayments might be. Easily adjust your loan amount, repayment type, and interest rate to see what your repayments could look like for your new Mojo home.

Simplify your budgeting process with our user-friendly budget planner calculator, designed to help you track expenses, set savings goals, and build your dream Mojo home.

Discover how extra repayments can reduce your loan term and interest costs with our easy-to-use extra repayments calculator.

Compare loan options effortlessly with our loan comparison calculator, helping you find the best rates and terms tailored to your financial needs.

Use our lump sum repayment calculator to determine how much you can save on interest and pay off your loans faster with a one-time payment.

Thinking about your financial future? Set a savings goal. This tool can project how much you can accumulate over time with an initial amount and ongoing contributions.

Stamp duty varies from state to state. Simplify your home building process with our stamp duty calculator, designed to help you estimate costs and budget effectively.

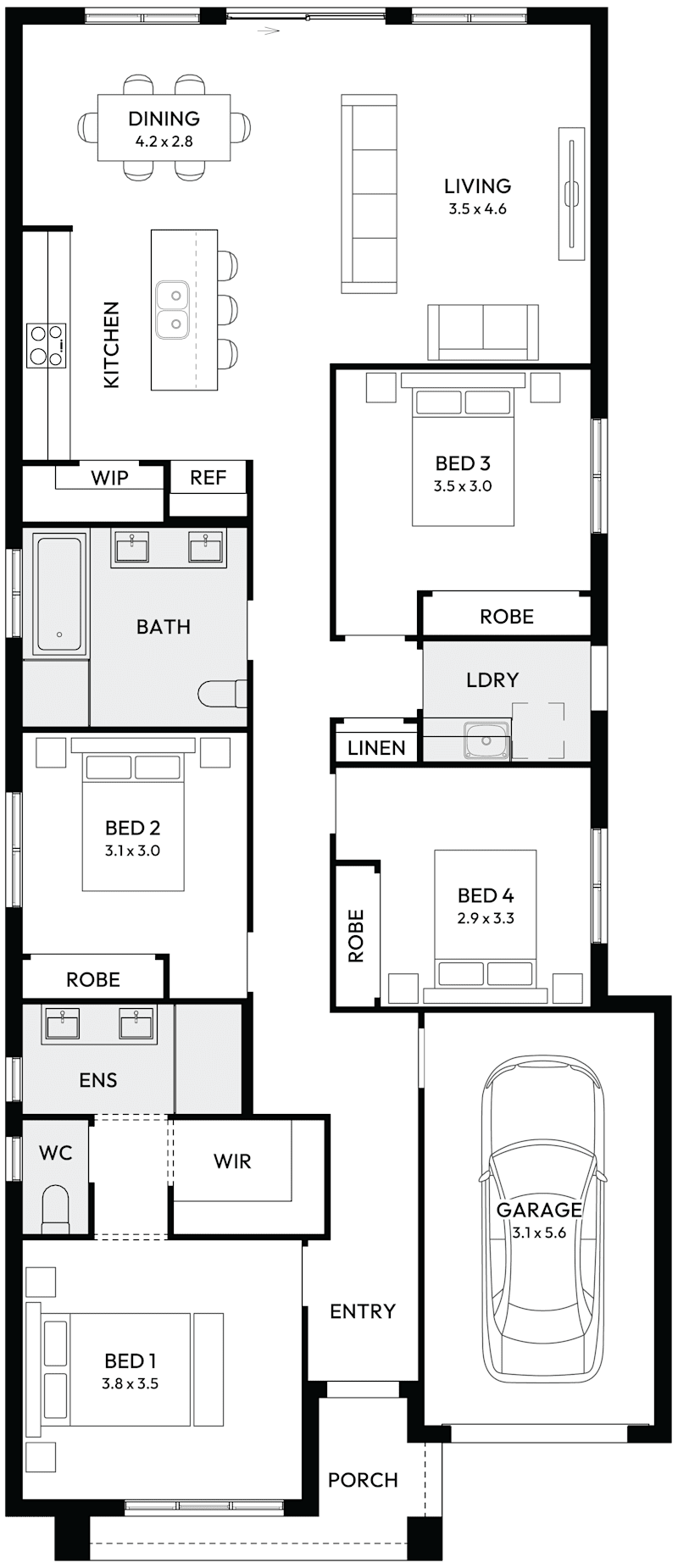

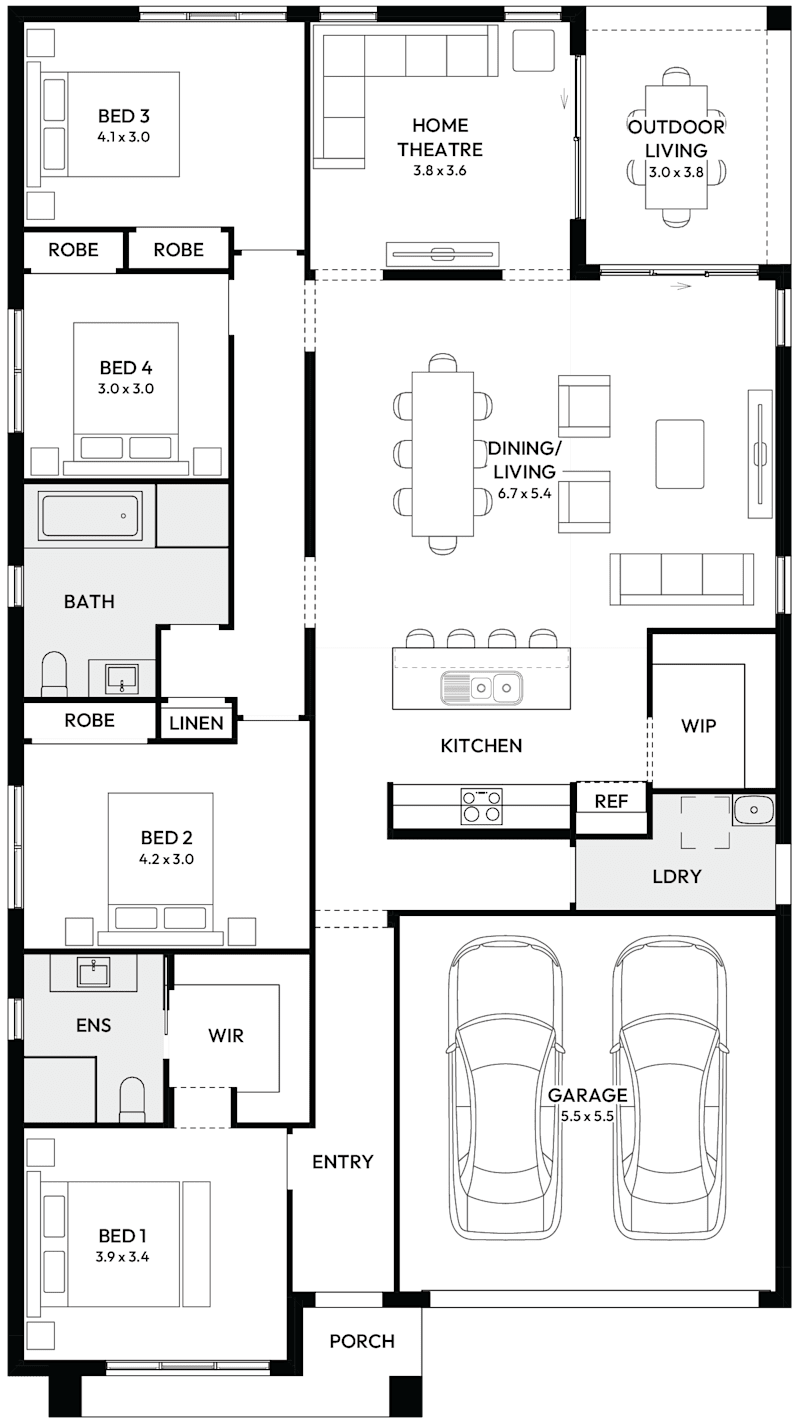

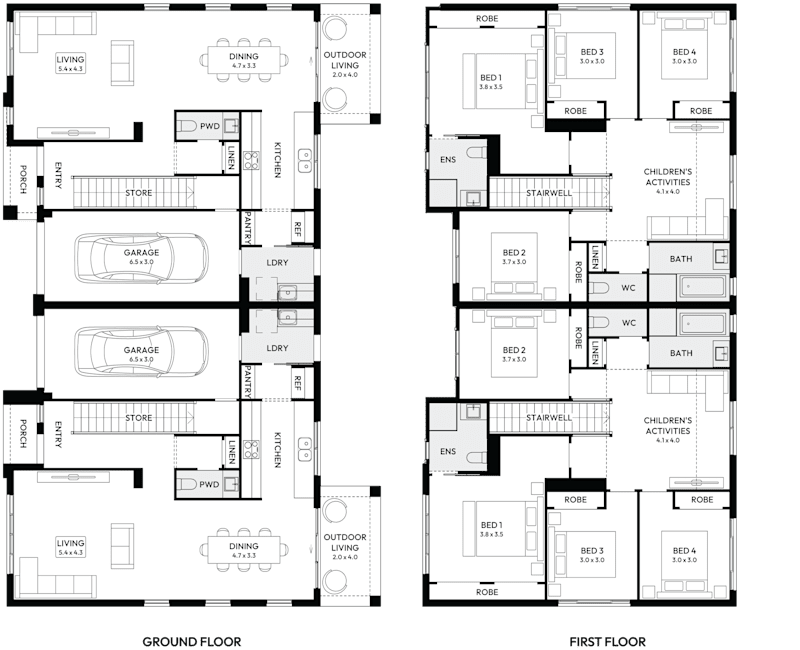

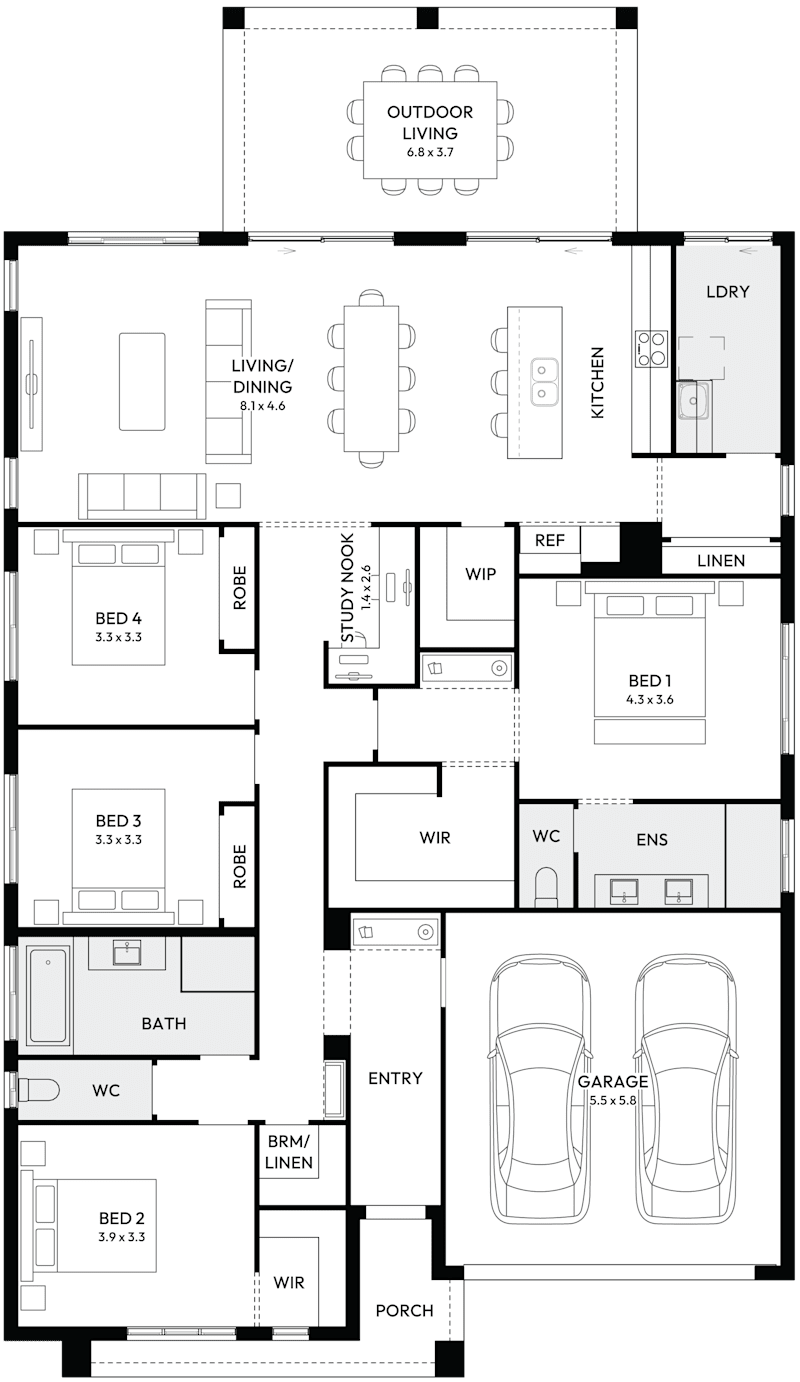

Find your perfect Mojo home by applying filters that match your unique design taste and lifestyle.

Log in to your MyMojo account and pick up where you left off.

With a MyMojo account, you can save and compare your favourite home designs, shortlist display homes you want to visit, and keep track of the house and land packages that catch your eye. You can also store your top blogs and inspiration images, floorplans, facades and promo options - all in one place.

A MyMojo account allows you to keep track of your favourite homes and house and land packages plus save your favourite images and articles to your own personal mood board to discover your style!

You can also save your chosen home design and your specific selections for later so you can discuss your options with your family and friends, make further changes if needed or compare with other designs. When you're ready talk to one of our friendly New Home Consultants to get your building journey started.

Please select your desired build region so we can personalise your content.